Calculating and reducing customer churn: the complete guide

It’s more cost-effective to hold onto a customer than it is to gain a new one. That’s why companies today are so focused on retaining the customers they already have (i.e. churn reduction). This is especially true for subscription-based SaaS companies that base their entire business model on recurring revenue.

No matter what kind of business you have, it’s important to hold onto as many customers as you can, creating a base that will continue to grow and pay off for years to come. These loyal return customers are the very backbone of profitability, so it’s in your best interest to keep them around.

But you’re not going to keep everyone. Some people will inevitably drop off. You just have to ensure that the number of customers you lose falls within an acceptable range. That’s why it’s so important to learn how to calculate customer churn accurately.

But how does one calculate customer churn? Is it difficult? Does it involve math?

Spoiler alert: yes, there’s some math, but you can use a calculator!

In this article, we’re going to teach you all about customer churn, including what it is, why it’s an important metric, and how you can accurately calculate it for the benefit of your organization.

What is customer churn?

Customer churn is a natural part of the business cycle. It occurs when a business loses customers. While that might seem like a scary concept, it’s important to remember that churn is something that every business goes through.

The bottom line is there’s no such thing as a churn-free business, and there’s no way to eliminate churn completely. All you can do is mitigate churn and try to keep it as low as humanly possible.

How do you do that?

Your customer success team is a huge part of the picture, providing quality customer support to the people who need it most. But there’s so much more involved in keeping your churn rate healthy.

Customer churn rate is the percentage of customers who churn during a specific period of time, whether it’s weekly, monthly, yearly, or quarterly. This is also known as customer attrition. They’re just different terms for the exact same thing.

But before we can get into the specifics regarding how to calculate the customer churn rate of your organization, let’s first discuss why it’s such an important metric that’s deserving of your attention.

Why is churn rate so important?

Customer churn determines how many existing customers you’ve lost. Given what we know about the importance of customer retention, churn is one of the most vital metrics that contribute to your company’s success.

It’s specifically important if your customers pay you on a recurring basis. A great example of this would be a subscription SaaS product like a CRM or project management platform. These companies rely on recurring revenue to keep their businesses in the black. In a successful subscription business model, you gain new subscribers while keeping most of your existing customers. This creates a snowball rolling downhill effect that will ensure your profitability in the long run.

However, if your churn rate is too high, you’re either treading water or your revenue is going down. On the other hand, if churn decreases, your Net Dollar Retention (NDR) or Gross Dollar Retention (GDR) will increase.

By knowing your churn rate, you’ll be able to ensure that you’re recouping the average customer acquisition cost for your business. You want to make sure that the money you’re putting out to attract new customers is lower than the money you’re pulling in from those customers.

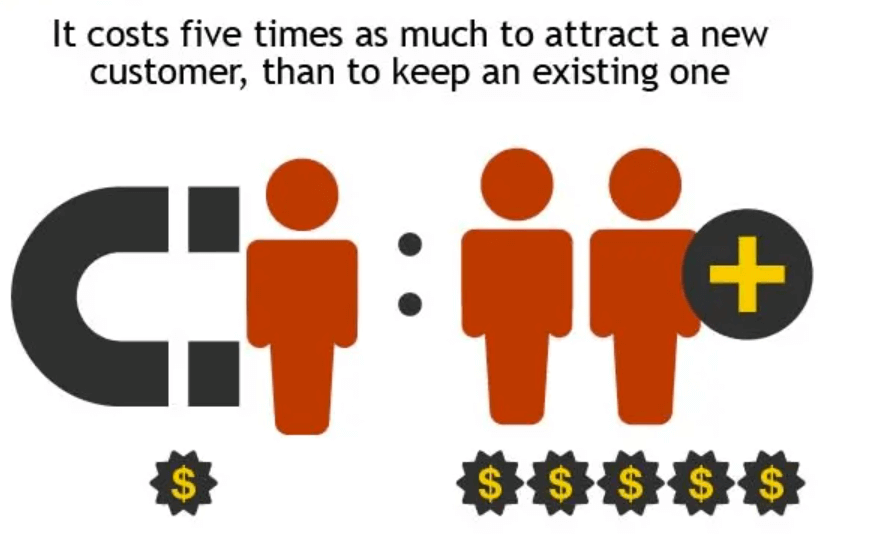

Retention is always the root of productivity for any business. It costs roughly five times more to bring on a new customer than it does to retain an existing one. On top of that, improving your retention rate by just a measly 5% can increase your bottom line by more than 25%.

Gong’s customer retention management software can help your CS team get the process dialed in.

Your churn rate is a window into your business. It shows how effective your company is, from marketing efforts to the overall efficiency and customer support. A high churn rate is a big red flag that means there’s a problem somewhere that you need to fix.

By understanding your customer churn rate, you’ll be able to see where you’ve been, where you are, and what you have to do to get to where you need to be. It could be that you’re doing an excellent job, and you merely have to fine-tune your already positive growth. However, you could also be losing customers by the truckload, leaving a huge hole in your potential for profit.

Without calculating customer churn, you won’t be able to tell which of those categories you fall into. It’s important to identify periods of high churn and the underlying factors that contributed to them.

First steps to calculating customer churn

You now understand why monitoring your customer churn rate is so important. Now it’s time to dive into the actual process of figuring out how to measure it.

Before we can actually break out the old calculator and start doing some math, there are a few things you have to know. There’s information that needs to be gathered to create the formula we’ll be going over in the next section.

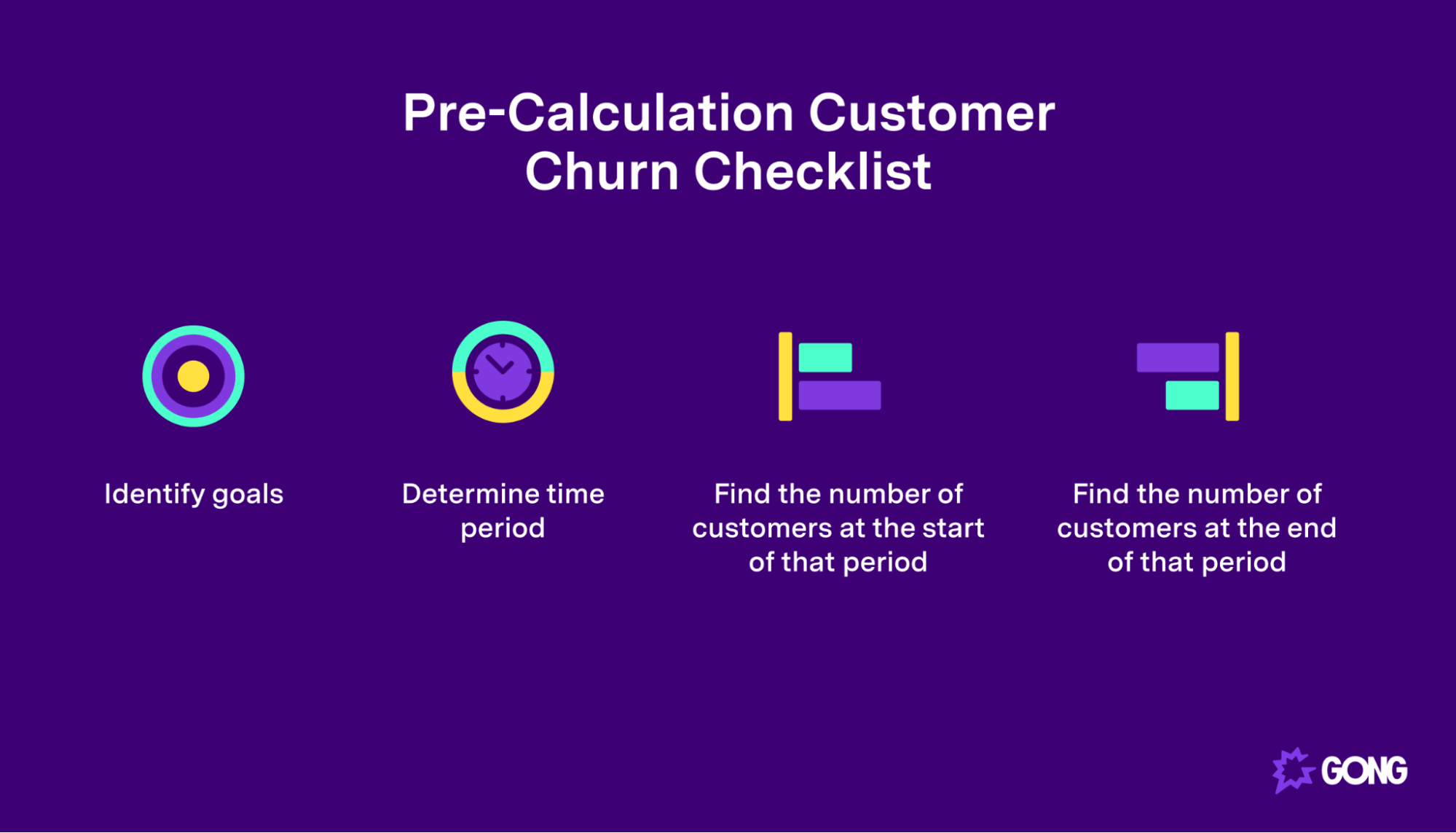

First, figure out what period of time you’re calculating churn for. When measuring churn, it’s possible to calculate a rate for any given time frame. You could go broad and try to figure out how many customers you’ve lost over an entire year. Once you know that, you could dig down into six-month intervals to determine when the bulk of the year’s churn occurred.

Then, you can break it down month by month. This will help you determine where you have to look if you want to identify the issues that are driving customers away.

Next, identify the number of customers that you started that time period with. This is the base number that you measure against. When you determine churn, it will be the number of people you lost from this exact period.

After that, you have to figure out how many customers churned during the period in question. So, if it’s an entire year that you’re measuring, check the number of customers you had at the end of that period and subtract that number from your starting point.

It’s also important to have a goal number in mind. Since churn is inevitable, you should understand the acceptable level for your company and industry and measure the results you’ll get in the next section against that.

Customer churn formula

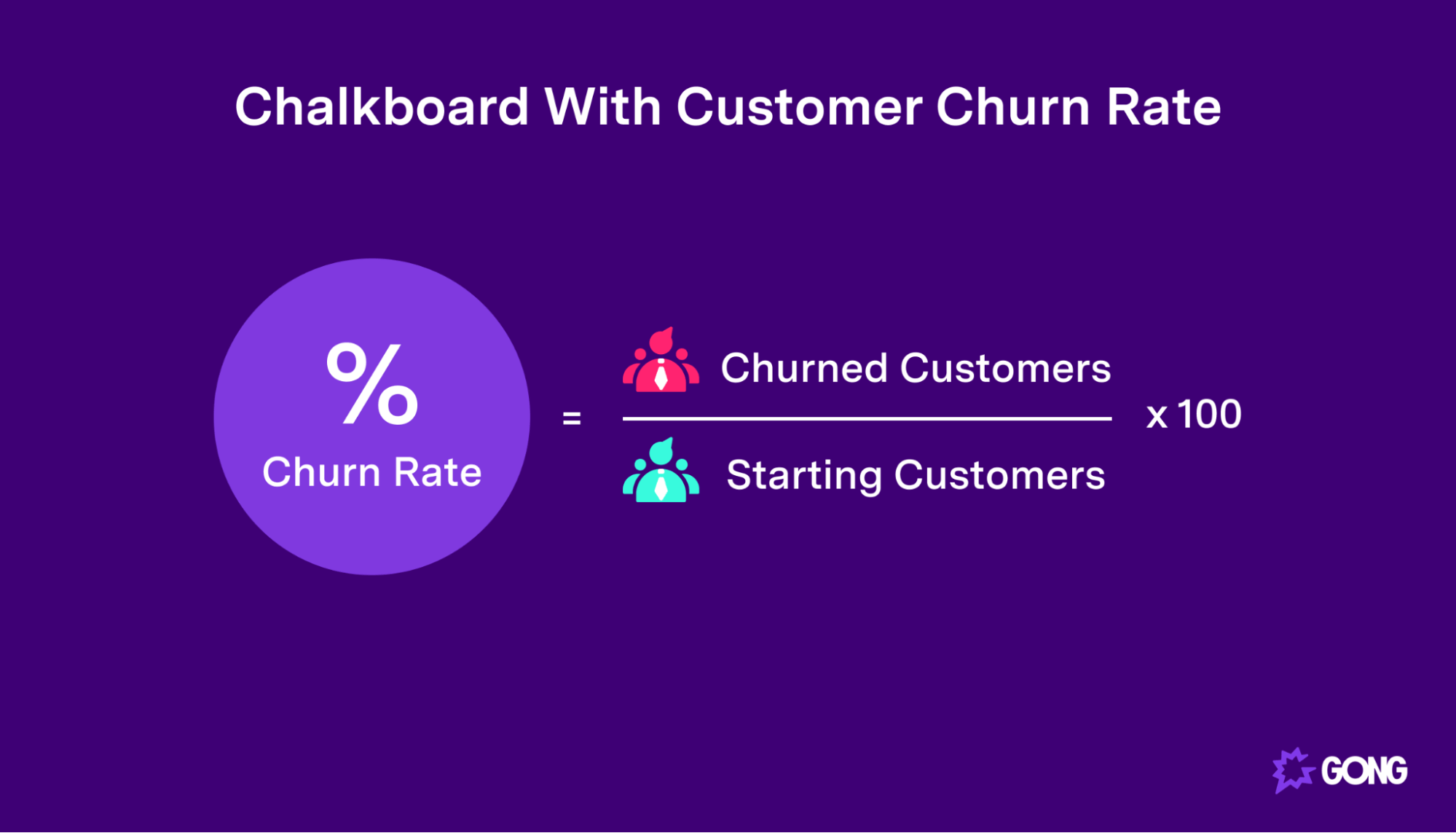

Calculating churn becomes a simple matter once you have all of the information we highlighted above. There’s a very straightforward formula that you can use.

We just have to divide the number of churned customers by the customers you started the observation period with. Once we have that result, we multiply the answer by 100 and have our churn rate.

Written out, it looks something like this:

(Churned customers/Starting customers) x 100

By applying this formula to your numbers, you’ll get an accurate percentage of your churn. If the number is grossly high, it becomes your job to figure out why this is the case and fix whatever the issue is.

Customer churn examples

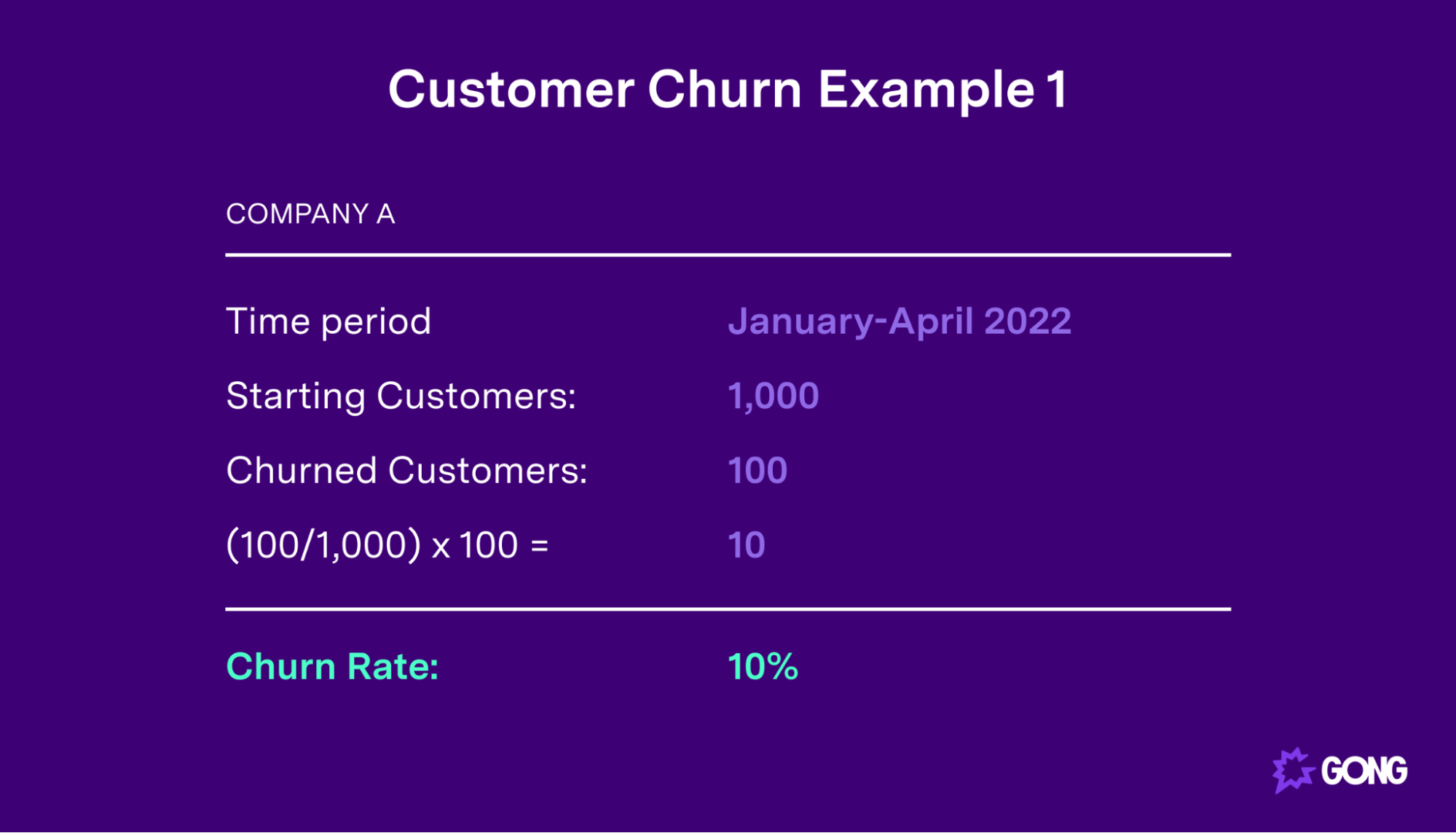

Now that we understand how to calculate churn let’s look at a few examples that can help better illustrate the process.

Say you started an observation period with 1,000 customers. At the end of that period, you have 900. You’ve lost a total of 100 customers.

Applying the formula to this specific example would look like this:

100/1000 = 0.1.

We’ve taken our churn total of 100 and divided it by our starting total of 1,000. That gives us a result of 0.1.

Now, we move to the second piece of this equation.

0.1 x 100 = 10

Our result of 0.1 multiplied by 100 gives us 10. That means we have a churn rate for this period of 10%.

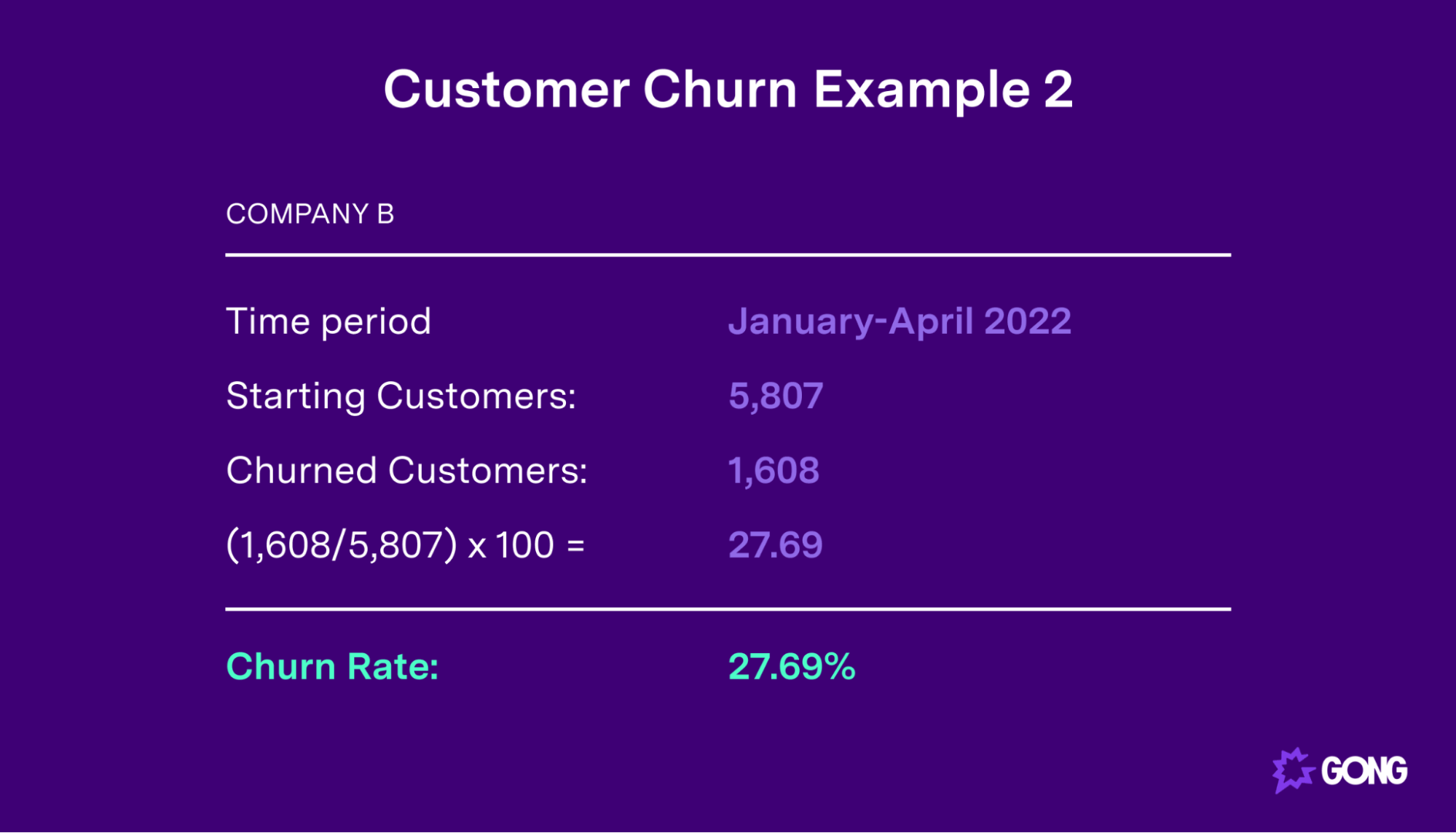

This was a rather simplistic example, and the numbers you’re going to work with won’t be so neat and round. Let’s take another look at an example that’s a little more realistic.

You started a quarter with 5,807 customers. You ended that quarter with 4,199 customers. By subtracting these numbers, we can tell that 1,608 customers have churned.

Now, let’s apply the formula.

1,608/5,807 = 0.2769

When we divide our churned customers by our starting number, we get 0.2769. While some might round this number to 0.28, it’s better to stay exact when determining something as crucial as churn rate.

0.2769 x 100 – 27.69

When we multiply this number by 100, we get a churn rate of 27.69%.

Here’s a real-world example. Netflix, one of the biggest streaming companies on the planet, has recently been having issues that can be tracked by a rising churn rate.

At the beginning of 2021, the company enjoyed one of the lowest churn rates in the streaming industry, at just 2.4%.

The company then raised prices in January of 2021, and by the end of March, the Netflix churn rate rose to 3.3%. When you examine this rise in churn, the major variable in question was the company’s decision to raise prices.

What to do once you know your customer churn rate

Once you know your customer churn rate, your work isn’t over. The real work can begin once you have this valuable information. It’s time to start taking steps to reduce customer churn.

First, you should have already determined your acceptable level of churn, which means you’ll be able to tell whether the level you’ve just measured is within that range.

It’s important at this moment to identify churn signals. This could be a sharp decline in your NPS scores, a champion client leaving their account, or conversations concerning renewals that customers have been avoiding. Once you’ve identified these telltale signs, it’s time to start looking into why this is happening.

A great window into the reasons behind churn can be found in customer reviews. Look at any customer feedback left on platforms like Google, NPS surveys, or your own product pages.

Your goal here is to determine the difference between the experiences of churned customers vs. those who remained. What was it that caused these specific people to leave? Are there any similarities between them?

There are some things you can do to decrease your churn rate.

First, ensure that the SaaS onboarding process is smooth and effective for new customers. If these first steps in operating your product are confusing or cumbersome, you’re not making a great first impression.

It’s also vital to work with customer success team members to improve the overall customer experience. With something as crucial to a B2B organization’s success as a SaaS solution, your clients need to be confident in the care they’re going to receive when problems come up. When clients call in for help, you can ensure they’re getting effective support quickly and in a way that appeals to them.

It’s a good idea to ask for customer feedback to determine how you can improve. You might also want to reach out to churned customers to see if you can woo them back with a special offer or send them a survey about why they decided to leave.

To avoid churn before it happens, work with your account team to prepare for renewal conversations. This will ensure that you’re maintaining high engagement levels with your current clients. That will help you gauge how they’re engaging with your product and how new features you’ve rolled out have been adopted.

Conclusion

Calculating churn rate is an essential KPI for modern customer success teams. It helps you identify issues that might have otherwise gone unnoticed and take action to correct them. From monthly churn to annual churn, understanding this vital metric will give you a leg up on customer retention and help you avoid a mass exodus.

Customer churn is just one area where you need complete visibility to grow your revenue. For more information on how you can increase visibility in other areas of your business, like market changes and team performance, reach out to Gong today.